If you are looking for the investment of your money, or you are someone who wants to invest. Here One such intriguing option is nutmeg. In this post, we are going to make your mindset clear about the nutmeg review. we have discussed all the aspects which should be considered before investing.

As we explore the value of nutmeg as an investment asset. this will review all the important its market dynamics, Nutmeg’s fees, nutmeg withdrawal process, is it safe or not. and all the related queries are discussed in briefly

We’ll also assess whether investing in nutmeg offers substantial returns or merely adds spice to a diversified portfolio.

Is Nutmeg a good investment platform for beginners?

Yes, Nutmeg is a good investment platform and suitable for beginners, especially those interested in a basic, hands-off approach to investing. Here is why:

Nutmeg makes it extremely easy for the person who does not have any skill or experience: one can simply create an account online, select an investment goal, and start investing without having in-depth knowledge of finance.

It also provides you with a range of managed portfolios, stopping your attitude toward risk and financial objectives. This can be instrumental for any beginning investor who may not feel confident about selecting specific stocks or managing their portfolio.

In this light, the minimum investment amount in the platform is fairly low compared to the traditional services of wealth management. This also makes it more accessible for people just starting out.

Nutmeg is very transparent with its fees. To the newer investor, hidden charges are important to consider. Fees are competitive but can sometimes add up, so it’s worth considering. Visit the Nutmeg website they also provide blogs and articles that could help a beginner learn more about investing as they go.

What are Nutmeg’s fees and how do they impact my returns?

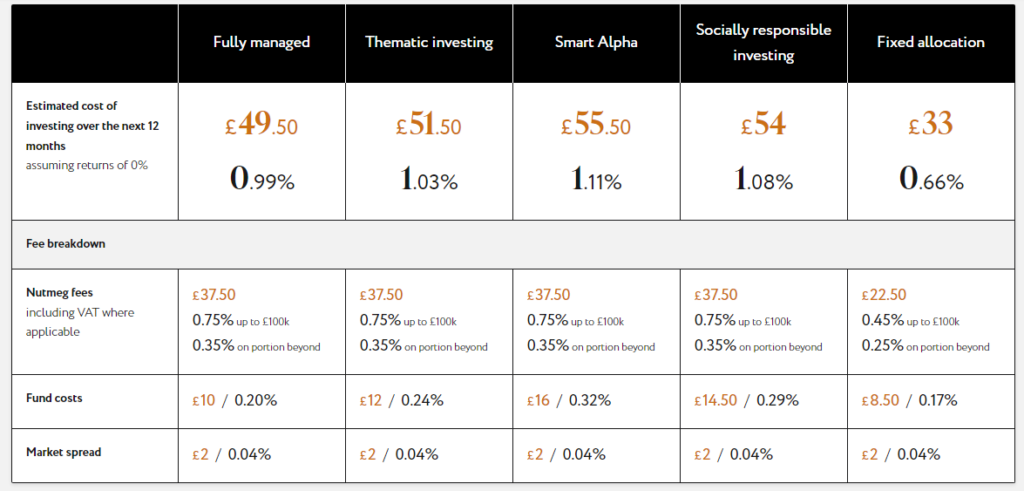

Nutmeg charges are applied annually depending upon your plan type. The below chart shows a percentage-based management fee, which varies depending on the type of portfolio and the amount you invest:

How Fees Impact Returns

Th more you pay the fee and less you get the investment return. Here’s how they can impact:

Lower Net Returns: Suppose your portfolio earns 6%, but you are paying 1% in total fees; the net return would be 5%.

Compounding effect: Fees can eventually add up through compounding over time. A fee that is ostensibly as small as 1% per year could eat into a surprisingly large portion of your returns in the long run.

Nutmeg vs Wealthify: Which is better?

Nutmeg and Wealthify are two biggest of the UK’s largest robo-advisors, but each is excellent for there different expertise reasons. In reality, which to use really depends on your needs and preferences. Here is a comparison that should help you decide:

1. Investment Strategy:

Nutmeg: Nutmeg offers a range of portfolios, from cautious through to adventurous. They invest in a mix of equities, bonds, and alternative assets; the option of fully managed or fixed allocation portfolios is available.

Wealify: Wealify also provides various levels of risk, but it more often follows a clear passive investment strategy with a strong belief towards the ETFs or Exchange-Traded Funds. Multi-asset class and global market diversified portfolios make up their portfolios.

2. Fees:

Nutmeg: Nutmeg charges an annual management fee on top of the cost of the investments. Their fees are pretty transparent, though a bit higher than that of some competitors for relatively smaller account sizes.

Wealthify: On the whole, Wealthify charges lower management fees as compared to Nutmeg which is a positive sign. In addition, they utilize ETFs, which are lower in ongoing costs. This makes Wealthify cheaper, especially for small investments.

3. Minimum Investment:

Nutmeg: Nutmeg is pretty more expensive, and the minimum investment required is a bit higher compared to some robo advisors. The minimum, at the time of my last update, was £500 for their fully managed portfolios.

Wealthify: Minimum investment requirements are lower in the case of Wealthify, making it more applicable to more investors. The minimum is usually in the region of £1, though this may be different.

4. User Experience:

Nutmeg: User-friendly interface and detailed performance reports, along with loads of educational materials. What’s more, this service will be able to provide personalized advice and numerous tools for planning.

Wealthify: An intuitive and user-friendly investment platform with simplicity at the forefront. They have less focus on a range of deep planning tools and more on ease regarding investment processes.

5. Additional Features

Nutmeg: Nutmeg offers Socially Responsible portfolios and the Junior ISA, among others. They also offer some human support and financial advice.

Wealthify: In its turn, Wealthify also offers a Junior ISA. It is highly automated with a straightforward approach. Wealthify focuses on making the cost low as much as possible, creating a seamless user experience.

How easy is it to withdraw funds from Nutmeg?

You can request a withdrawal through the Nutmeg online system via the website or through the mobile app.

You can simply log in, choose which portfolio you would like to withdraw from, and follow the on-screen steps that pop up to request your withdrawal.

Nutmeg will sell the investments in your portfolio and process the withdrawal. Money normally takes about 3-7 business working days, this depends on how long it takes to sell your investments and actually transfer the funds.

Nutmeg doesn’t charge when you withdraw your money.

Is nutmeg profitable?

Over the last couple of years, Nutmeg has not been found to be consistently profitable compared with other Fintech startups.

Nutmeg has focused on growing its customer base and building its own growth. Even though Heavily invested in marketing, Nutmeg did not reach profitability as an independent company and has been acquired by JPMorgan Chase.

What is Nutmeg’s customer reviews?

Most probably customers of Nutmeg are satisfied with their investment and portfolio accounts. Some of the recent reviews of the customer review are given below.

Is my money safe with Nutmeg: can it be trusted?

Nutmeg can be considered a safe and reliable platform through which one can manage his or her investment. It has several security layers over your money and investments.

Because Nutmeg is regulated under the guidance of the FCA, it is required to operate within strict financial and operational guidelines. This typically means that clients are safeguarded against fraud or fake practices.

Nutmeg is covered by the FSCS, a scheme covering up to £85,000 of your money should Nutmeg go out of business. It applies to cash held in your account; the investment itself isn’t covered for any market losses.

Nutmeg separates customer assets from its own company money, which means that even if Nutmeg ran into financial troubles, your money would still be safe. That’s what FCA call the segregation of client assets.

Can I transfer my ISA or pension to Nutmeg?

Yes, you can transfer your ISA or pension to Nutmeg. Here’s how it works in both instances.

ISA Transfer to Nutmeg

ISA transferable types: Nutmeg accepts in Stocks and Shares ISAs, Cash ISAs, and Innovative Finance ISAs.

How it is transferred: You open a Nutmeg ISA online and start the transfer process online; Nutmeg will take over the rest with your current provider.

No Loss of Tax Benefits: Transferring an ISA to Nutmeg does not affect your ISA allowance or your tax benefits, provided the transfer is properly effected.

Approximate duration: ISA transfers take approximately 2-4 working weeks, depending on your current provider and the type of ISA.

Transfer of a Pension (SIPP) to Nutmeg:

Transferable pension types: Nutmeg accepts the transfer of defined contribution pensions, including personal pensions and other SIPPs. Transfers of defined benefit pensions – final salary pensions, for example – are not permissible, nor are pensions in drawdown.

How to Transfer: You can start the process of your pension transfer by simply opening a Nutmeg SIPP account online. Nutmeg will then contact your current pension provider on your behalf and complete the transfer.

Transfer Time: 4 to 8 weeks average time for the transfer of pension, depending on the provider you are transferring from.

Nutmeg lets you hold multiple pensions in one place if you prefer the idea of consolidating your retirement savings into one SIPP account.

What are the risks of investing with Nutmeg?

As with any other investment platform, there are some risks associated with Nutmeg when investing in it. The important thing to know beforehand is to make the right decision for investment. This kind of risk is by no means peculiar to Nutmeg, as it does often come with basically most forms of investing.

1. Market Risk:

The value of your investments may go down as well as up, based on how the market graphs perform. Portfolio accounts by Nutmeg are exposed to equities, bonds, and other securities that are all subjected to market volatility. No returns can be guaranteed, and you may get back less than you invest.

2. Inflation Risk:

If the inflation rate is higher than that return from your investment, then you have lower purchasing power with money. This becomes relevant for low-risk portfolios, which cannot grow fast enough to outrun inflation.

3. Currency Risk:

Nutmeg has internationally diversified portfolios, which implies that some of your investments could be in overseas-based assets. Where the exchange rates change, this will impact investment valuation. For instance, a high pound may reduce the sterling value of investments denominated in foreign currencies.

4. Interest Rate Risk:

Changes in the interest rate also impact certain investment values, like bonds: the higher interest rates rise, the lower the price of your bonds on hand and overall investment performance.

5. Liquidity Risk:

Nutmeg investment typically involves assets that can usually be bought and sold with reasonable ease. Sometimes, however, certain investments may become less liquid at times when markets get volatile. This means a slight delay in drawing money when the price is in your expected range.

Some pros and cons of nutmeg investment review

| Pros | Cons |

|---|---|

| Tax-efficient accounts: Nutmeg offers ISAs and pensions, among other investment accounts, with basic tax efficiencies. | Potential hidden costs: Even though the fees are transparent, there are other external costs, such as the fees for the ETF funds, that still apply and will impact overall return. |

| Low fees: Nutmeg’s management fees stay competitive with the more traditional investment services. | Limited investment options: Nutmeg primarily focuses on ETFs without providing broad exposure to different asset classes, such as individual stocks or mutual funds. |

| User-friendly interface: an intuitive interface makes this platform easy to work with even for those who have just started working with such websites. | No financial advisor access: Nutmeg does not offer specialist one-to-one personal advice from a dedicated financial advisor.. |

| Automatic portfolio management: Nutmeg does implement automatic portfolio management and rebalancing using algorithms on behalf of investors. | Performance can vary: Like any other investment type, returns can be very volatile, especially when economies are in decline.. |

| Diversified range of portfolio options: Nutmeg does not have one generic portfolio but a range differentiated by risk tolerance and goals, such as socially responsible investing. | UK-focused: Nutmeg is primarily designed for investors based in the UK, limiting options for those outside of the UK. |

| FCA Regulated: Nutmeg is regulated by the Financial Conduct Authority, adding an extra layer of trust and security. | Requires a minimum deposit: The minimum investment required to start with Nutmeg is far higher and, therefore, may not suit very small |